Generate Demurrage Charges |

Miscellaneous Transactions for Demurrage will calculate for a Customer Service based on the totals days without activity between activity dates using the designated Miscellaneous Transaction Code. Demurrage can be calculated prior to billing through Generate Demurrage Charges or automatically during Route Completion. Demurrage miscellaneous transactions will be included on the subsequent customer Unbilled Revenue, Invoice and Miscellaneous Transaction Listing. Unbilled Demurrage can be Modified or Deleted from Account Inquiry. Also see Related Topics.

How Demurrage is Calculated

Demurrage Days counter starts on the day of the first demurrage flagged service activity completed to the next demurrage flagged service activity completed.

Example #1

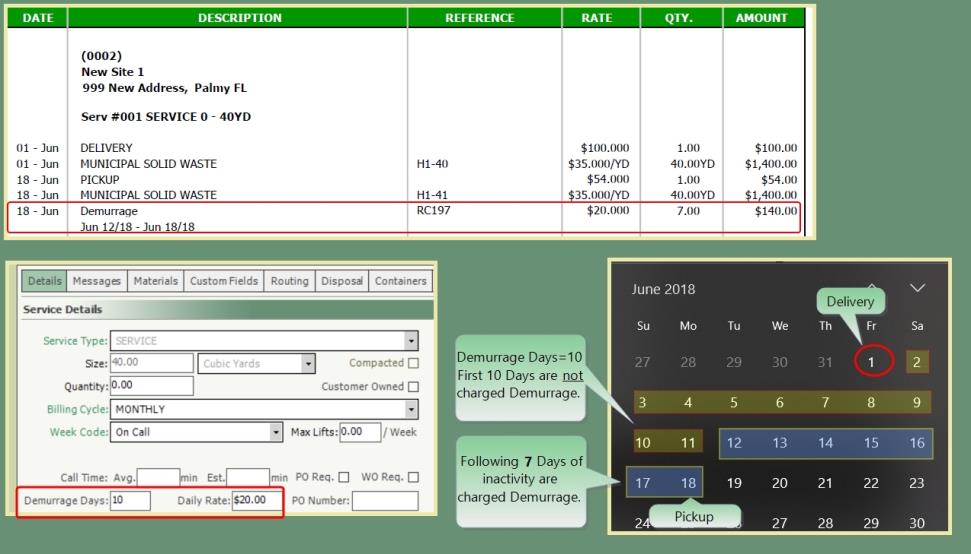

- Demurrage Days = 10

- Rate = $20.00

- Demurrage activity scheduled and completed on October 1.

- Next Demurrage activity scheduled and completed on October 15.

- Days 1-10 are not charged Demurrage.

- 4 Days of Demurrage are calculated @ $20.00 per day.

- Upon completion of the demurrage calculated service activity, the day counter resets to 1. (Until the service is stopped).

Example #2

- Demurrage Days = 10

- Demurrage activity scheduled and completed on October 1.

- Next Demurrage activity scheduled and completed on October 7.

- Demurrage activity is only 6 days which is less than 10 days.

- No Demurrage is calculated .

-

Counter will reset and the service has another 10 day window to have another demurrage activity service scheduled and completed before the Demurrage starts calculating again. (Unless the Service is Stopped).

Example #3

- Demurrage Days = 10

- Demurrage activity scheduled and completed on October 1.

- There is no further activity as of November 1.

- Demurrage Charge will not be calculated until the next demurrage activity is scheduled and completed.

-

To avoid having the customer receive a large Demurrage Charge, Generate_Demurrage_Charges can be run prior to the next customer billing. This will generate a demurrage charge up to a date selected rather than a single large demurrage charge upon the completion of the next demurrage activity which could potentially be greater than 30 days.

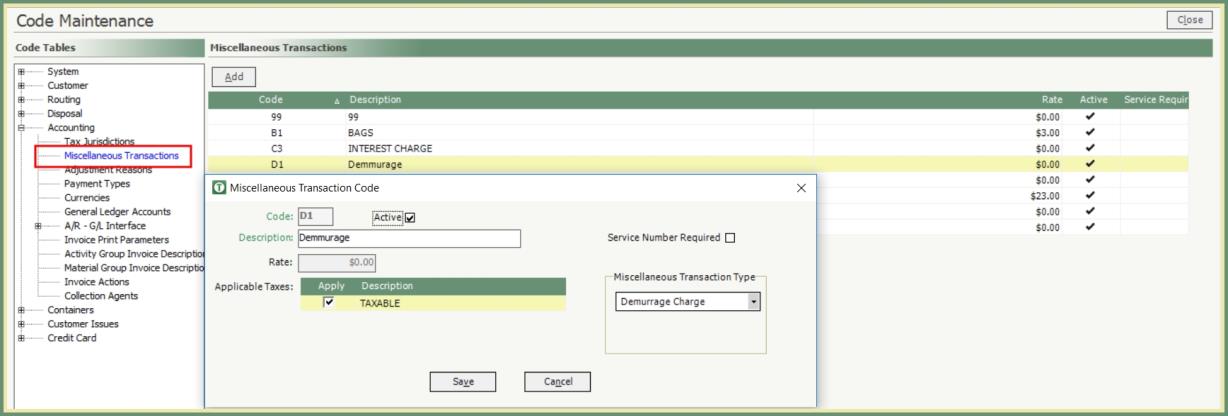

Demurrage Miscellaneous Transaction Code

Note: A miscellaneous transaction code with a Demurrage type setting is necessary prior to generating Demurrage charges.

Navigate To: System>Configuration>Code Maintenance>Accounting>Miscellaneous Transactions

- Click Add.

- Enter a unique two-digit Code.

- Enter a description for the Demurrage code.

- Enter Rate (optional, as this can be specified on the service level).

- Select applicable taxes, if charged.

- In the Miscellaneous Transaction Type drop down, select Demurrage Charge.

-

A Miscellaneous Transaction with the type set to Demurrage is required to use the Demurrage functionality. Any code set to Demurrage cannot be used when entering Miscellaneous Transactions.

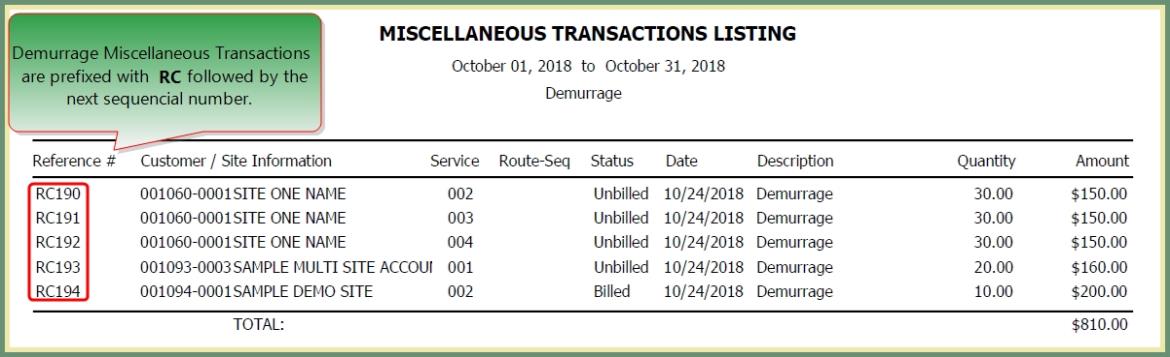

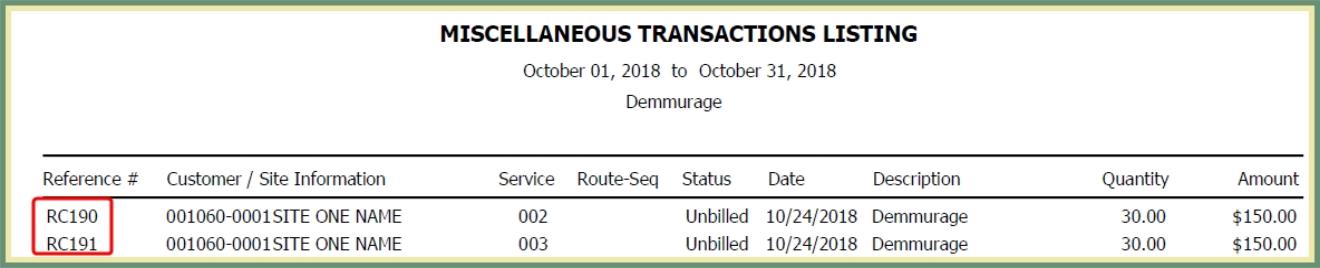

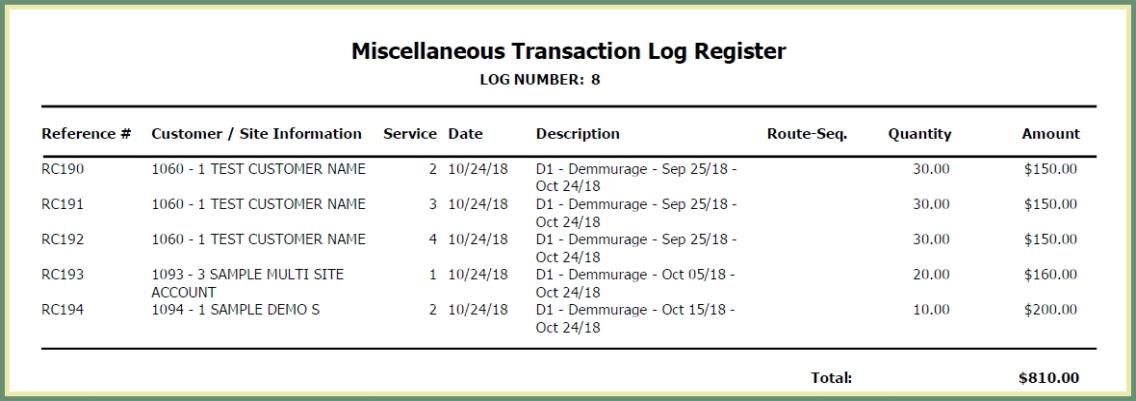

- Demurrage Charges are generated with a Miscellaneous Transaction Number prefixed with the letters RC.

- Save.

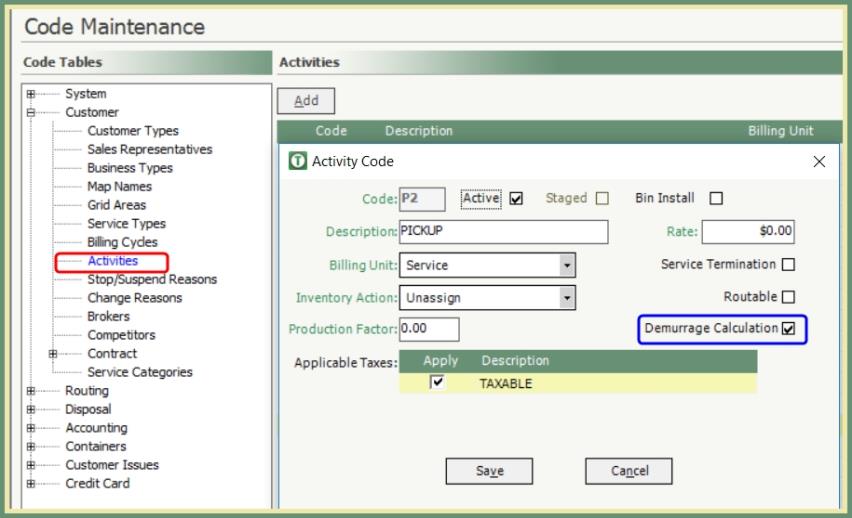

Add Demurrage to Activity Code

Navigate To: System>Configuration>Code Maintenance>Customer>Activities

- Add New Activity or Recall an Existing Activity.

- Check the Demurrage Calculation.

- Save.

- Repeat for each activity that should calculate Demurrage.

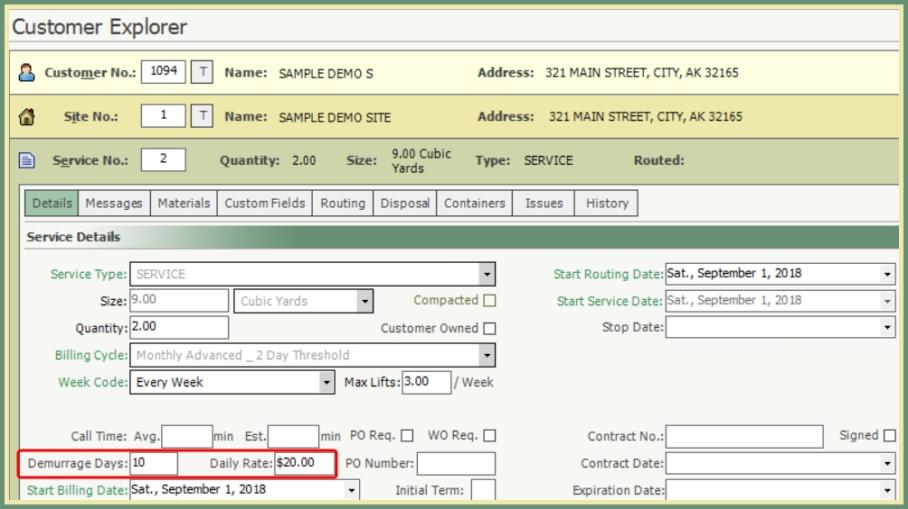

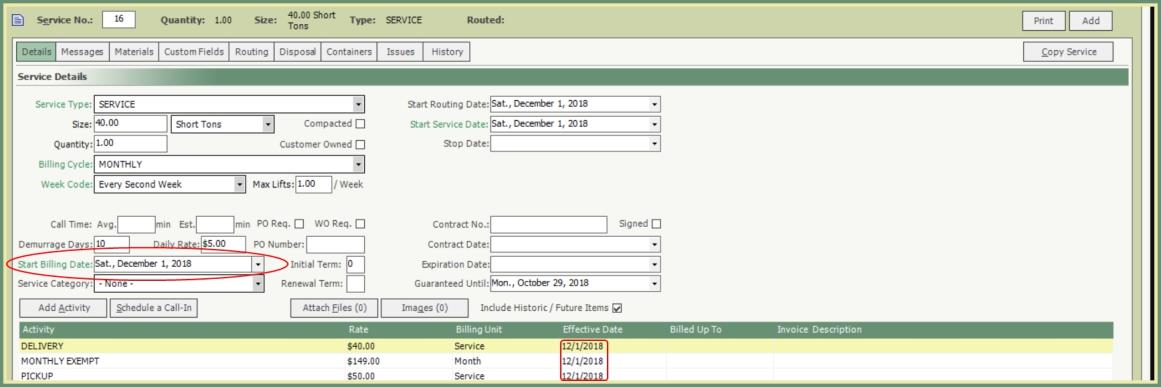

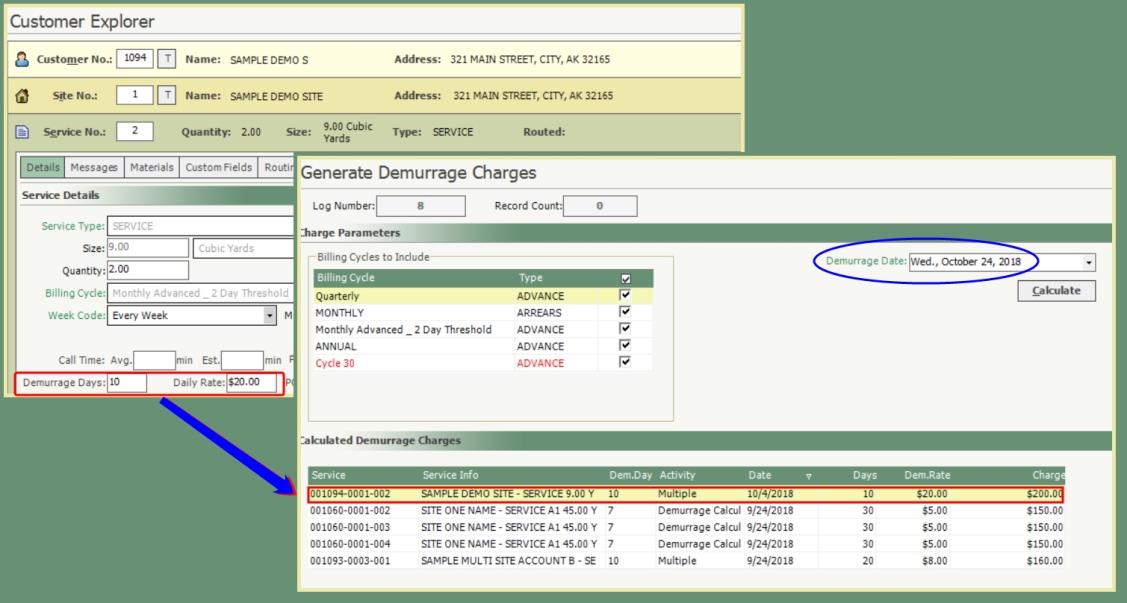

Add Demurrage Charge To Service

Navigate To: Customers>Customer Explorer

- Open Customer>Site>Service.

- In the Service Details tab, enter the Demurrage Days.

- Enter the Daily Rate.

- Save.

- If charging Demurrage for multiple containers, create a separate service for each container.

-

Do not combine multiple containers with Demurrage calculations on a single service.

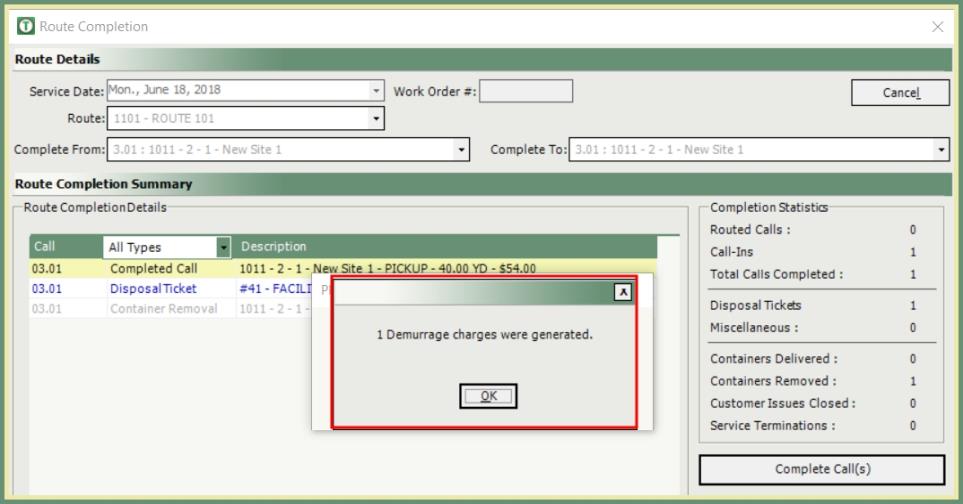

Demurrage Calculation in Route Completion

- Route completion will automatically calculate Demurrage.

- Demurrage will calculate for services with Inactivity beyond the Demurrage Days.

- Do not re-open a closed service with Demurrage calculations. The system will begin charging demurrage based on the last demurrage activity date for this service.

- If the last demurrage activity on this service was in January and the service has since been closed and re-opened in December, TRUX will calculate Demurrage charges back to January.

- Create a new service with a start billing date and activity effective dates with the new dates for this service (December based on the example).

-

Demurrage calculations counter will begin once the activity is scheduled on this new service as usual.

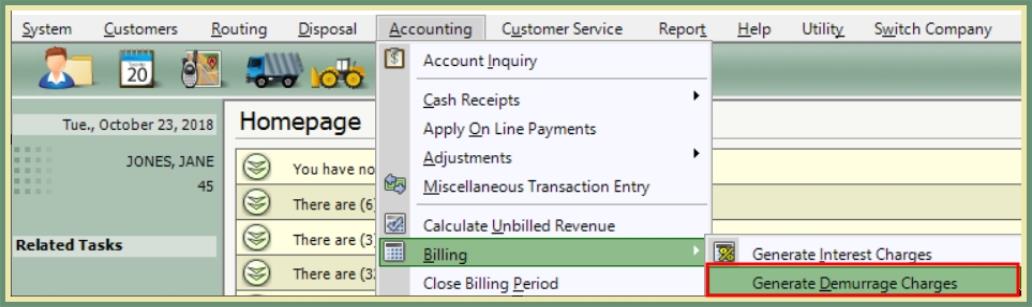

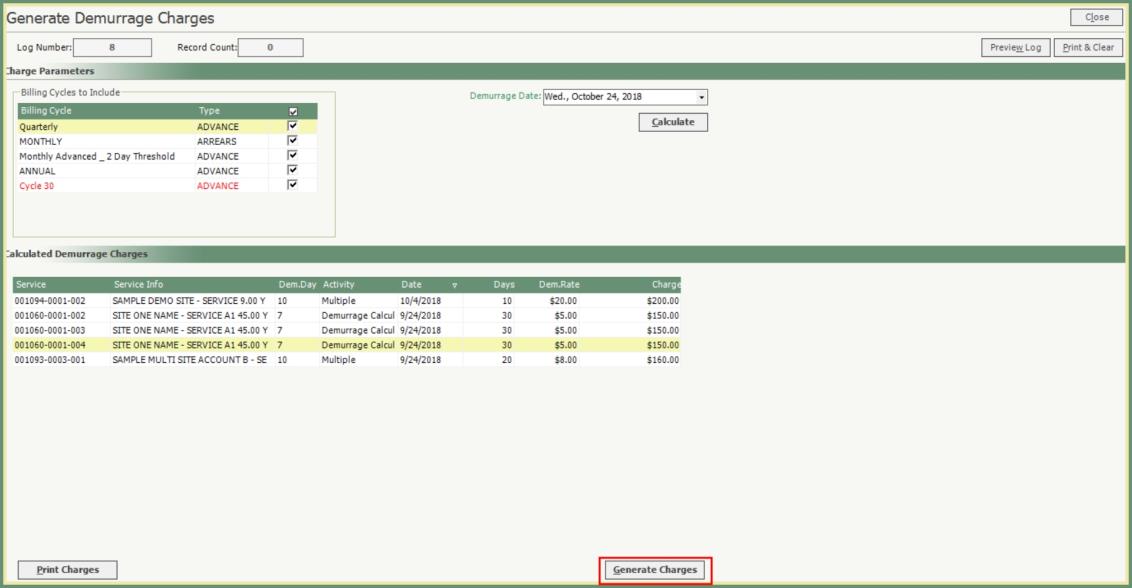

Generate Demurrage Charges is used to generate demurrage charges up to a date selected and will calculate demurrage charges for activities over the demurrage date without a subsequent activity completed to reset the counter. This allows you to generate smaller demurrage charges incrementally on the customer invoice rather than awaiting the next service activity completion and avoid a single large demurrage charge.

Navigate To: Accounting>Account Inquiry>Billing>Generate Demurrage Charges

- Select the Billing Cycles to Include

- Select the Demurrage Date. The Demurrage Charges will calculate up to and including this date.

- The Calculated Demurrage Charges grid will populate with qualifying services.

-

Click Generate Charges.

- Review the details in the grid.

- Print charges prior to calculating, (optional).

- Click Calculate. Demurrage Charges will generate as indicated in the grid on the customer account.

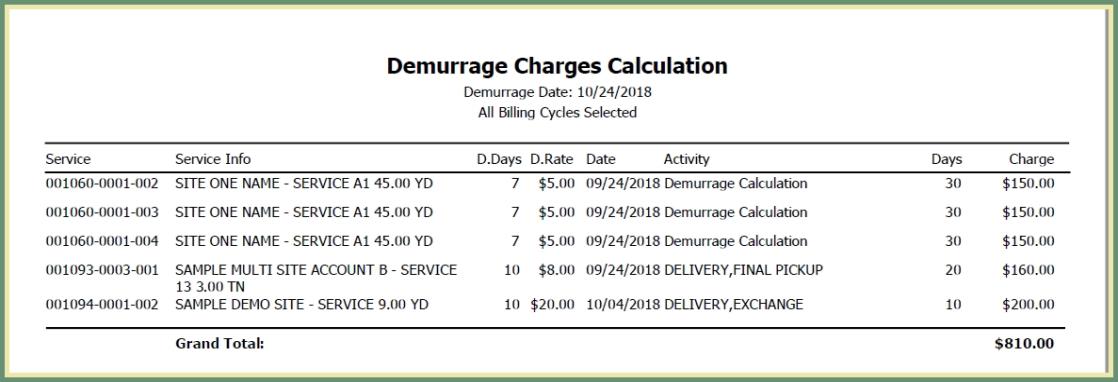

- Demurrage calculations are generated based on the Demurrage Date & Inactive Days after Service Demurrage Days X Daily Rate.

- Print and Clear log.

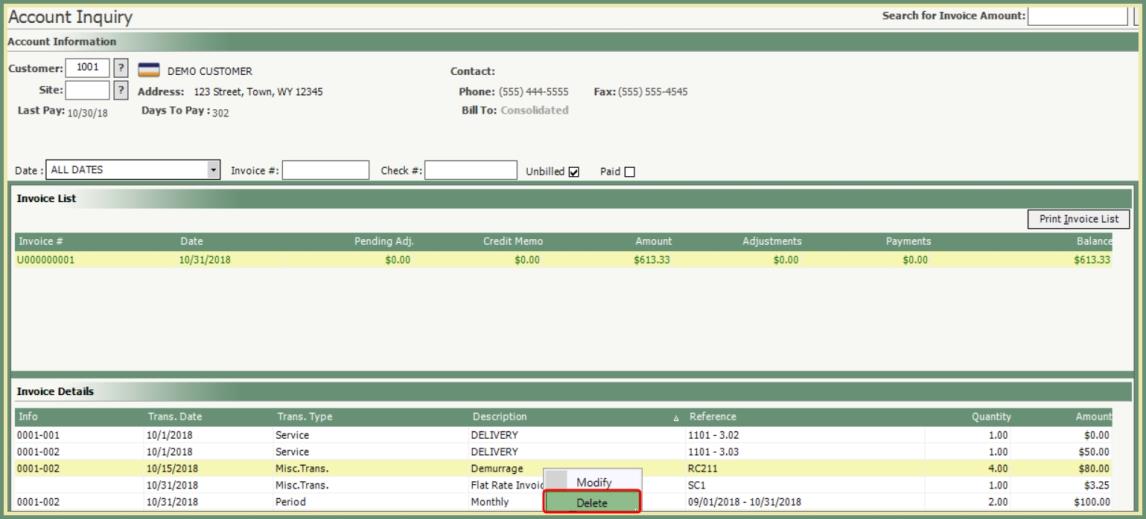

Modify or Delete Demurrage Charges

- Unbilled Demurrage Charges can be modified or deleted from Account Inquiry.

- Right click on the unbilled Demurrage charge in the Invoice Details grid.

- Select Modify to edit the Demurrage Miscellaneous Transaction.

- Select Delete to Delete the Demurrage Miscellaneous Transaction.

- Demurrage charge can be re-created from Generate Demurrage Charges.

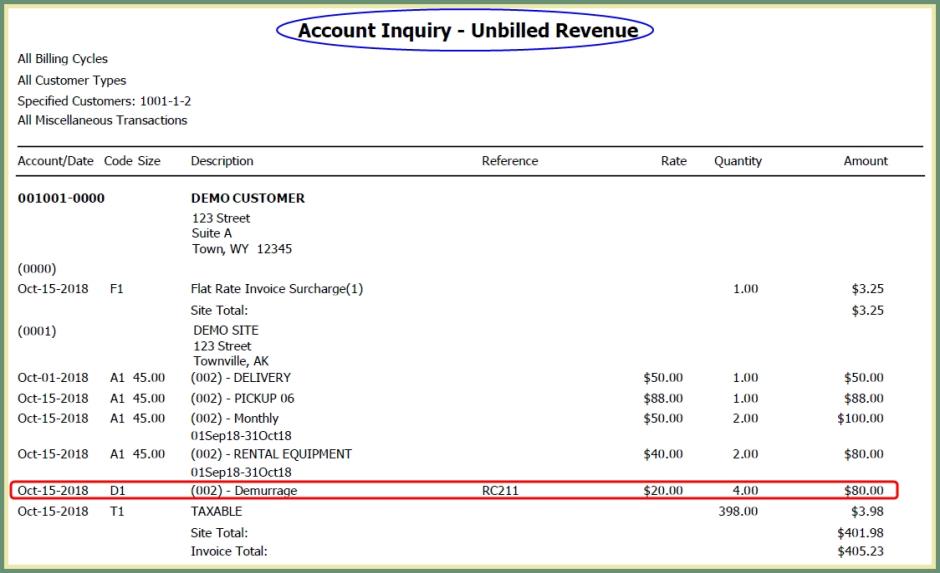

Navigate To: Accounting>Calculate Unbilled Revenue

- Enter unbilled parameters, as usual.

- Miscellaneous should be included in the Charge Types to Bill.

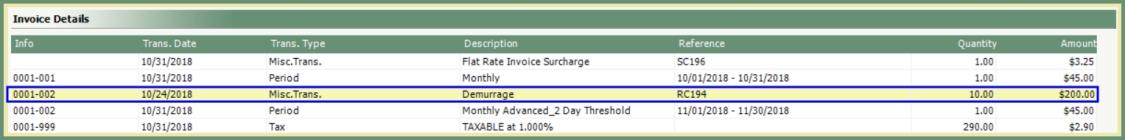

- Presumed Invoice Date should include the completed demurrage service activity date.

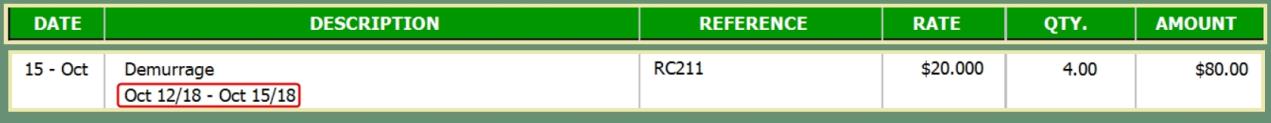

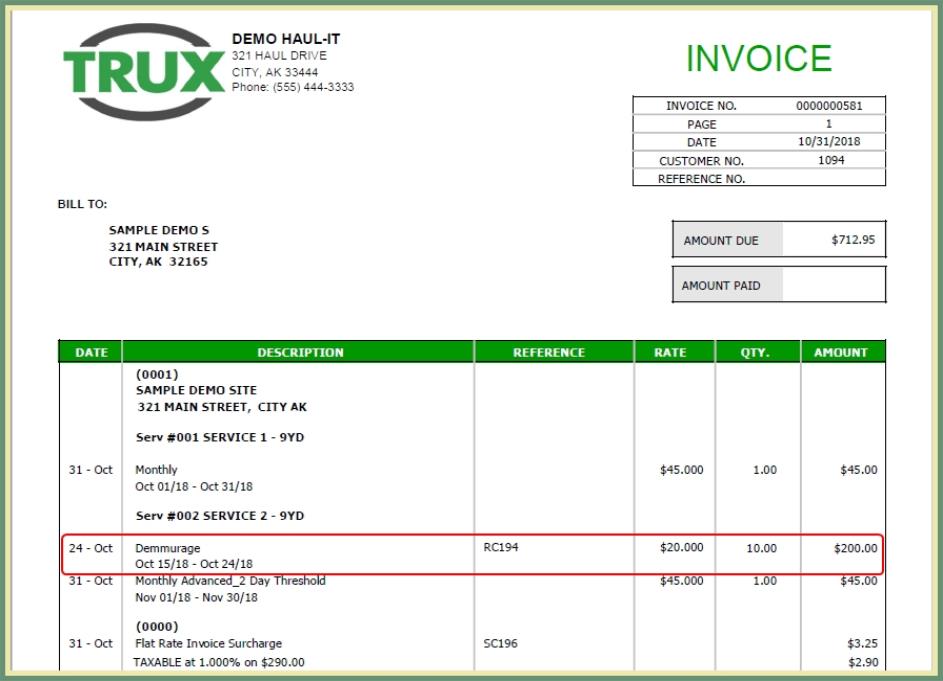

- Demurrage charges are included on the next invoice for the miscellaneous transaction date.

- The date range used in calculating the Demurrage charge are listed directly beneath the Demurrage transaction.

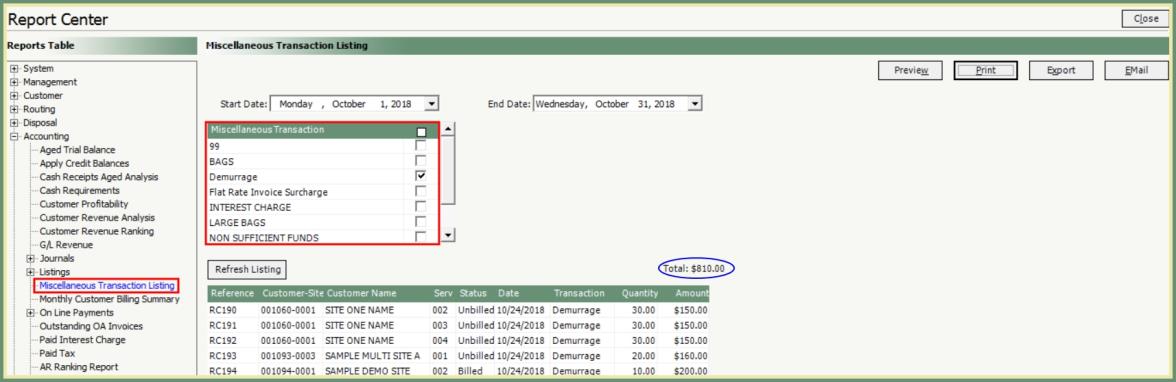

Generate a list of specific miscellaneous transactions by date and selecting the Demurrage miscellaneous transaction code.

Navigate To: Report>Report Center>Accounting>Listings>Miscellaneous Transaction Listing

- Select Start and End Date.

- Select the Miscellaneous Transaction code used for Demurrage from the Miscellaneous Transaction grid.

- The bottom grid will populate with the qualifying Miscellaneous Transactions.

- Click Refresh after changes to the parameters to refresh the grid content.

- Total will indicate the total value amount of the transactions in the grid.

- Select print, preview, email or export output.